5 Inspiring How To Determine Sales Tax - In this article, we’ll cover everything you need to know about sales tax. Determining when sales tax applies you’ve been working with sales tax for a while, but you still find yourself asking whether a specific product or service is subject to sales tax or is exempt.

How to Add Sales Tax 7 Steps (with Pictures) wikiHow . Supreme court’s 2018 decision in south dakota v.

How to determine sales tax

7 Popular How To Determine Sales Tax. You’ll learn what sales tax is and if you even need to charge sales tax. Add 100 percent to the tax rate. To calculate the sales tax that is included in a company's receipts, divide the total amount received (for the items that are subject to sales tax) by 1 + the sales tax rate. How to determine sales tax

Subtract the tax paid from the total. 3) column f is the sales amount. Sales tax nexus is defined as a connection a person or business has with a taxing jurisdiction. How to determine sales tax

This formula is automatically applied to almost every purchase made, with some exceptions depending on state and municipality. $50 x 0.06 = $3. The sales tax formula is: How to determine sales tax

When you enter the street address, the calculator uses geolocation to pinpoint the exact tax jurisdiction. Convert the tax rate to a percentage. Item price x sales tax rate = total sales tax. How to determine sales tax

In other words, if the sales tax rate is 6%, divide the sales taxable receipts by 1.06. If a company is in new york or connecticut, for example, the state can tax 20% of the company’s profits if 20% of its sales are made in the state. In legal terms, this is known as having sales tax nexus there. How to determine sales tax

When to charge another state's tax. Then, we’ll share a variety of different formulas to help you figure out how to calculate sales tax for your business. Unfortunately for them, amazon will now collect sales tax from customers in 24 states as of early 2015. How to determine sales tax

$3 + $50 = $53. “nexus” is the requisite contact between a taxpayer and a state before the state has jurisdiction to tax the taxpayer. Total sales tax + item price = final amount paid. How to determine sales tax

You would typically collect sales tax for another state only if you have a physical presence in that state. Let’s take a closer look at these other factors and how to. Multiply the result from step one by the tax rate to get the dollars of tax. How to determine sales tax

Start by determining whether you have a compliance obligation in a state. Your physical presence might be a retail store, a warehouse, or a corporate office, even if the facility is not open to the public. The concept of economic nexus came into existence in 2018 after the supreme court case south dakota v. How to determine sales tax

The sales tax formula is used to determine how much businesses need to charge customers based on taxes in their area. It defined the thresholds by which a remote business establishes sales tax nexus with no physical presence in the state simply by selling. State and local governments across the united states use a sales tax to pay for things like roads. How to determine sales tax

Take the total price and divide it by one plus the tax rate. Subtract the dollars of tax from step 2 from the total price. Convert the total percentage to decimal form. How to determine sales tax

[total taxable sales price] x [sales tax rate in decimal form] = sales tax amount. The excel sales tax decalculator works by using a formula that takes the following steps: How to calculate sales tax backwards from total. How to determine sales tax

You may also be interested in printing a north carolina sales tax table for easy calculation of sales taxes when you can't access this calculator. 2) i sorted by sale just to isolate the sales to determine the sales tax. To calculate the sales tax that is included in a company's receipts, divide the total amount received (for the items that are subject to sales tax) by 1 what is the taxes on $2500? How to determine sales tax

If so, register with your state’s taxing agency before collecting any sales tax. This level of accuracy is important when determining sales tax rates. Knowing when and how to charge for sales tax is critical for small business owners. How to determine sales tax

You can use our north carolina sales tax calculator to determine the applicable sales tax for any location in north carolina by entering the zip code in which the purchase takes place. Wayfair, a physical presence in the state was required for sales and use tax nexus. How to determine sales tax

Cara Menghitung Laba Bersih dalam Akuntansi wikiHow . Wayfair, a physical presence in the state was required for sales and use tax nexus.

Cara Menghitung Laba Bersih dalam Akuntansi wikiHow . Wayfair, a physical presence in the state was required for sales and use tax nexus.

Can TaxJar help me determine how much sales tax SHOULD . You can use our north carolina sales tax calculator to determine the applicable sales tax for any location in north carolina by entering the zip code in which the purchase takes place.

Can TaxJar help me determine how much sales tax SHOULD . You can use our north carolina sales tax calculator to determine the applicable sales tax for any location in north carolina by entering the zip code in which the purchase takes place.

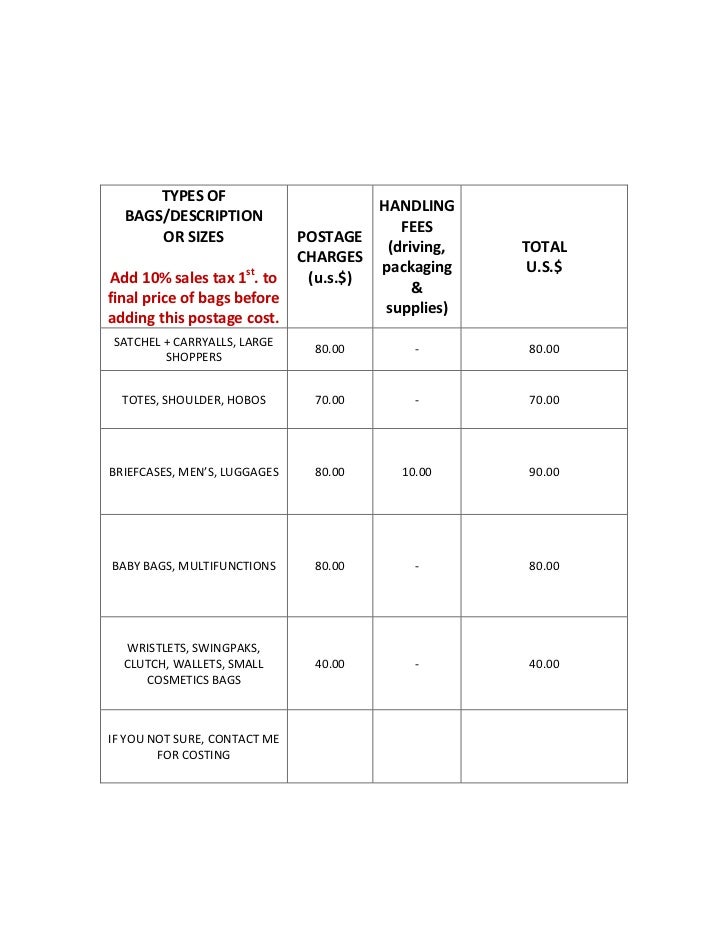

HOW TO CALCULATE SALES TAX, POSTAGE, + FINAL PRICE OF . Knowing when and how to charge for sales tax is critical for small business owners.

HOW TO CALCULATE SALES TAX, POSTAGE, + FINAL PRICE OF . Knowing when and how to charge for sales tax is critical for small business owners.

Tax Facts . This level of accuracy is important when determining sales tax rates.

Tax Facts . This level of accuracy is important when determining sales tax rates.

How to Figure out and calculate sales tax « Math . If so, register with your state’s taxing agency before collecting any sales tax.

4 Ways to Calculate Sales Tax wikiHow . To calculate the sales tax that is included in a company's receipts, divide the total amount received (for the items that are subject to sales tax) by 1 what is the taxes on $2500?

Comments

Post a Comment