8 Remarkable How To Check Etin Number - Generally, businesses need an ein. These services change monthly or annual fees.

Ekrem Akkaya Address, Phone Number, Public Records Radaris . Any previously filed tax return will also contain your ein.

Ekrem Akkaya Address, Phone Number, Public Records Radaris . Any previously filed tax return will also contain your ein.

How to check etin number

8 Success How To Check Etin Number. Edit tin certificate banglades, tin certificate change status, how to etin certificate change contact.#tincertificate#tin_certificate_bangladesh#tincertifica. Tax number anyone who has already filed a tax return has been assigned with a tax number, which consists of 13 digits and is changed each time your local tax office changes (after a move). Eventually, you can start with melissa, a free database covering all addresses recognized by the u.s. How to check etin number

During these reviews, the irs may notify us that the tax information in your account is inaccurate or out of date. If you used your ein to open a business The fiscal agent is considered a billing agent, and so will be using its own etin for claiming (837) and remittance (835) file processing. How to check etin number

An employer identification number (ein) is also known as a federal tax identification number, and is used to identify a business entity. Here’s how to find it in minutes. For providers, the medicaid provider id will determine payment. How to check etin number

Etin your employer uses this number to transmit all tax data to the tax office. Immediately a message will be sent to your mobile number. Learning your business tax id number—aka employer identification number (ein)—is easier than you think. How to check etin number

Done, all you have to do is wait for the email from bir regarding the issuance of your tin number. Another way to check whether or not an ein is valid is to use online databases. A credit score is an essential part of american financial life. How to check etin number

This is a free service offered by the internal revenue service and you can get your ein immediately. Fein search, ein finder and real search are all good resources. You may apply for an ein in various ways, and now you may apply online. How to check etin number

The typical etin number is 12 digit and if you had any tin numbers before; B) pay the annual registration fee (p500.00) at the authorized agent banks of the rdo. Irs issues itins to individuals who are required to have a u.s. How to check etin number

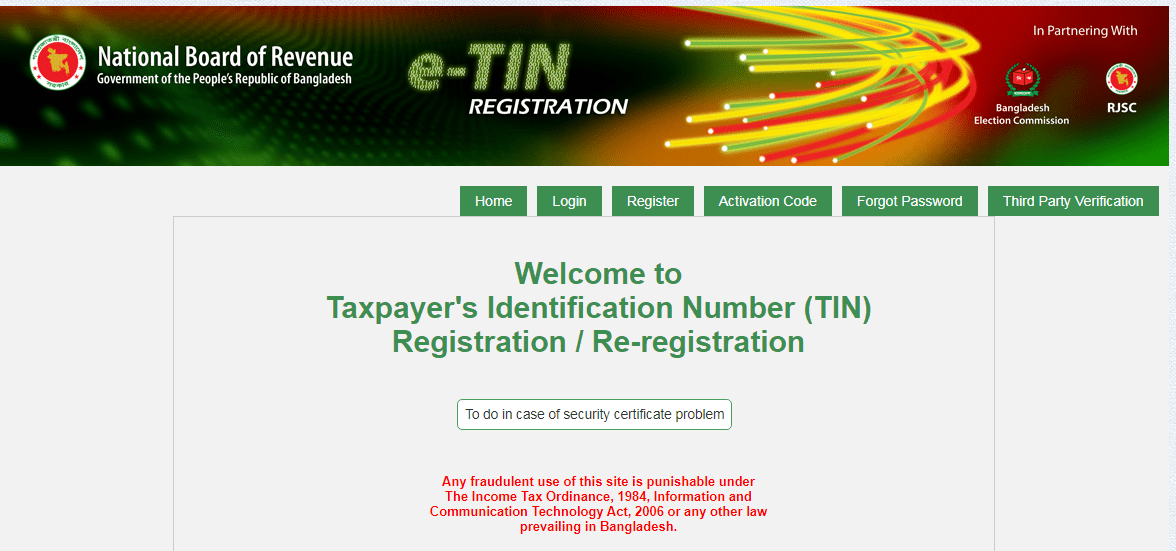

Etin registration is very easy process but most of the people don’t know, how to get digital tin number. How to check your credit score with an itin number is easy, and we’ll explain why you should do it when building your credit in the u.s. First, you have to click on the registrar button then you have to register with the user id, password, security question, email address, and mobile number. How to check etin number

You just need national id card numbers, your personal mobile number and if you own a company or proprietary; Check to see if you have any notifications from the irs , they will usually include your ein number in any letters or notifications. Tax identification number (tin) verification process. How to check etin number

You might need to register for new etin numbers online. Taxpayer identification number but who do not have, and are not eligible to obtain, a social security number (ssn) from the social security administration (ssa). An individual taxpayer identification number (itin) is a tax processing number issued by the internal revenue service. How to check etin number

Then you need those documents as well. In that case, we will place your payments on hold until you re. The irs issues itins to individuals who are required to have a u.s. How to check etin number

Before registration, they have to create user name and password. Input your tin (firs or jtb tin) in the search value field and click on the search button. A) accomplish bir form 1901and submit the same together with the required attachments to the revenue district office having jurisdiction over the registered address of the trusts. How to check etin number

Select tax identification number on the select search criteria dropdown list below. After login, etin registration will be available. If you want to replace a lost tin id, you may need to provide an affidavit of loss and submit bir form 1905. How to check etin number

Double check all the details you’ve entered, make sure all are correct, email address is working, then click “submit”. If your english is not good enought, try to find somebody who can help you. For check itin status you have to call: How to check etin number

Google periodically verifies publisher tax information with the united states internal revenue service (irs). The electronic bureau of internal revenue forms (ebirforms) was developed primarily to provide taxpayers with an alternative mode of preparing and filing tax returns that is easier and more convenient. Then they can login using new user name & password. How to check etin number

Is the transaction with etin secure? An individual taxpayer identification number (itin) is a tax processing number issued by the internal revenue service. An etin is an electronic transmitter identification number used in electronic transactions to identify who is sending and who is receiving a file. How to check etin number

Yes, security features are embedded in the system. Yet another way to verify your tin number is to pay a visit to the nearest bir revenue district office (rdo). How to check etin number

CMS 1500 ICD 10 WYOMING Manual CMS1500 4 1 17 . Yet another way to verify your tin number is to pay a visit to the nearest bir revenue district office (rdo).

CMS 1500 ICD 10 WYOMING Manual CMS1500 4 1 17 . Yet another way to verify your tin number is to pay a visit to the nearest bir revenue district office (rdo).

Eatl Apps . Yes, security features are embedded in the system.

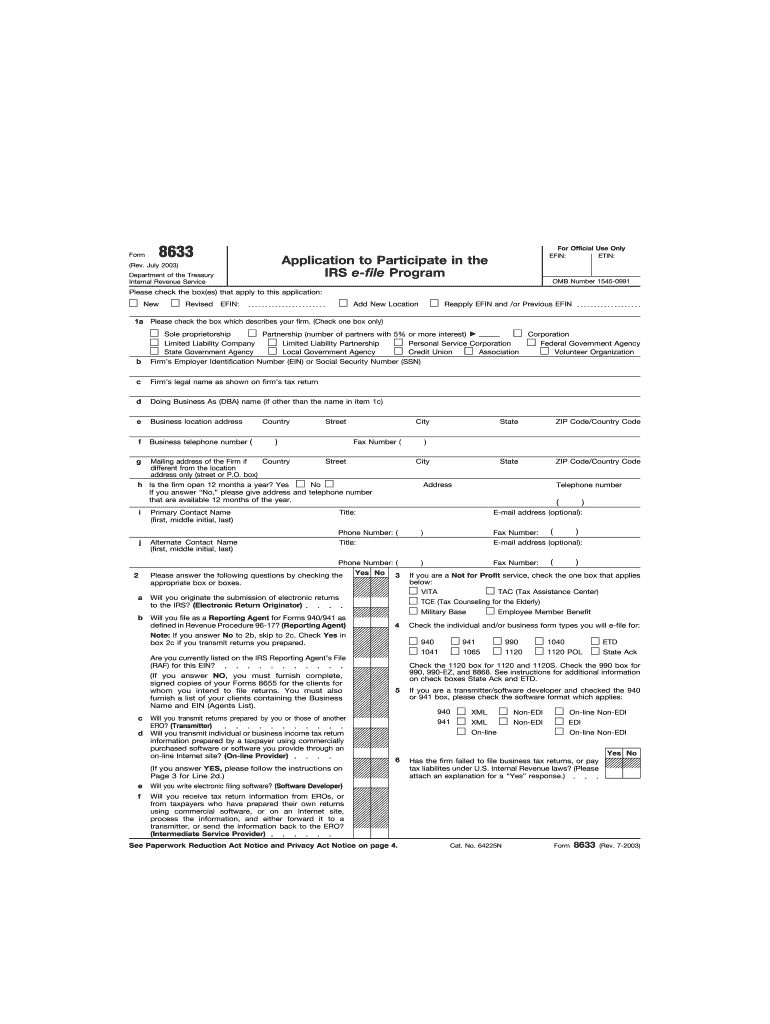

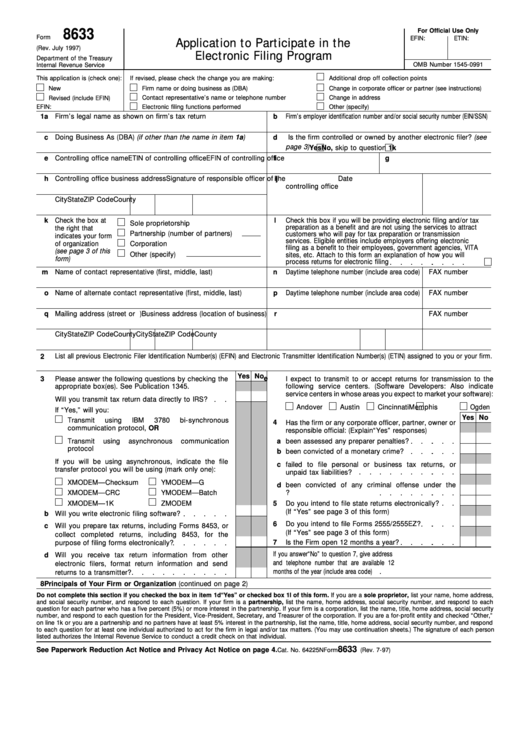

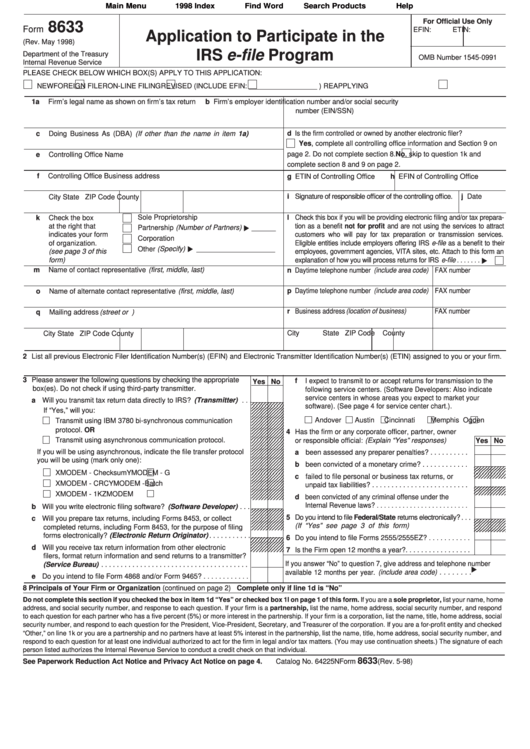

Application E File Fill Out and Sign Printable PDF . An etin is an electronic transmitter identification number used in electronic transactions to identify who is sending and who is receiving a file.

Application E File Fill Out and Sign Printable PDF . An etin is an electronic transmitter identification number used in electronic transactions to identify who is sending and who is receiving a file.

How To Collect E Tin Certificate From Online In BD (only 5 . An individual taxpayer identification number (itin) is a tax processing number issued by the internal revenue service.

How To Collect E Tin Certificate From Online In BD (only 5 . An individual taxpayer identification number (itin) is a tax processing number issued by the internal revenue service.

Form 8633 (Rev. July 1997) Application To Participate In . Is the transaction with etin secure?

Form 8633 (Rev. July 1997) Application To Participate In . Is the transaction with etin secure?

Fillable Form 8633 Application To Participate In The Irs . Then they can login using new user name & password.

Fillable Form 8633 Application To Participate In The Irs . Then they can login using new user name & password.

Comments

Post a Comment