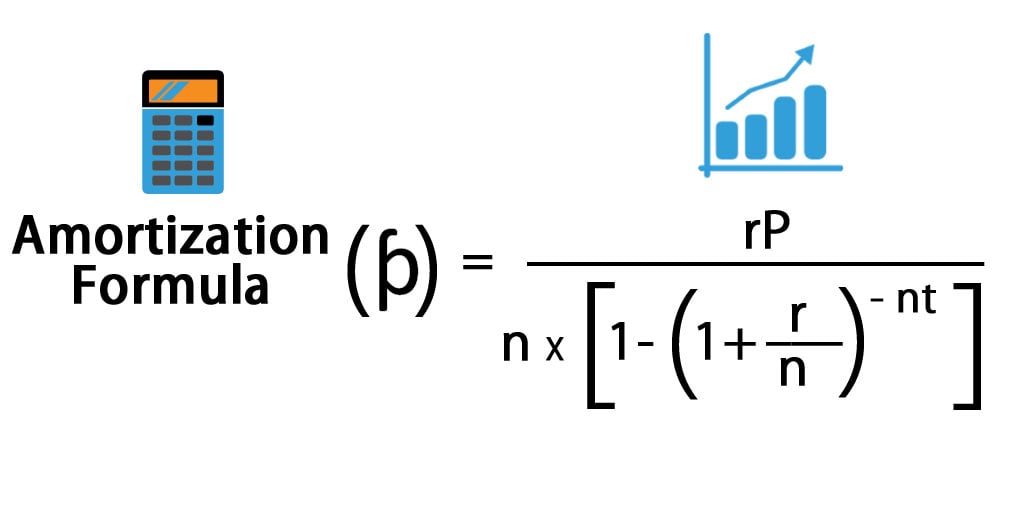

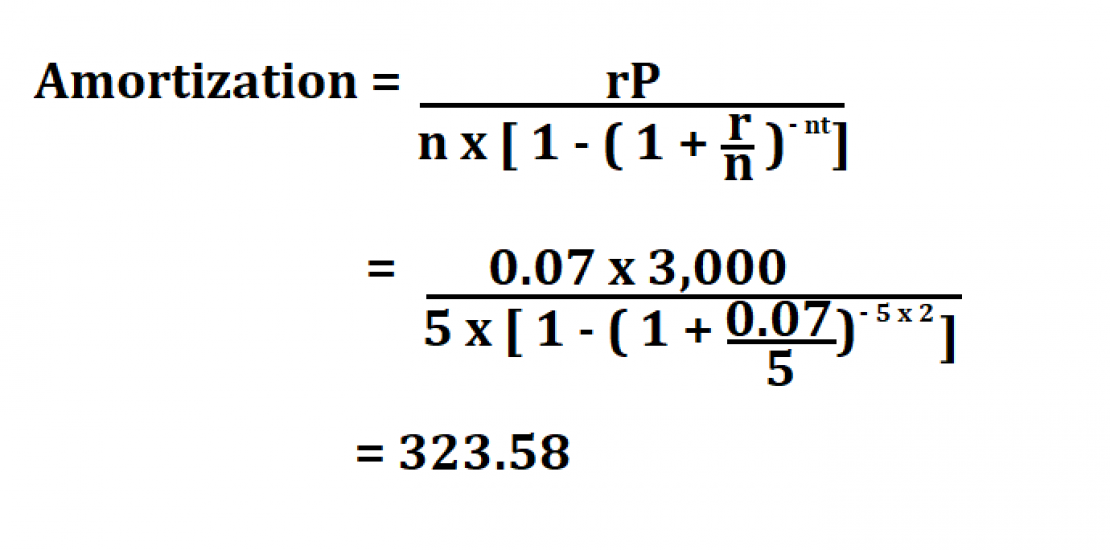

10 Inspiring How To Calculate The Amortization - A loan amortization schedule is calculated using the loan amount, loan term, and interest rate. Amortization is the accounting process used to spread the cost of intangible assets over the periods expected to benefit from their use.

Amortization Formula Calculator (With Excel template) . Learn how to calculate an amortization schedule for a mortgage loan.

Amortization Formula Calculator (With Excel template) . Learn how to calculate an amortization schedule for a mortgage loan.

How to calculate the amortization

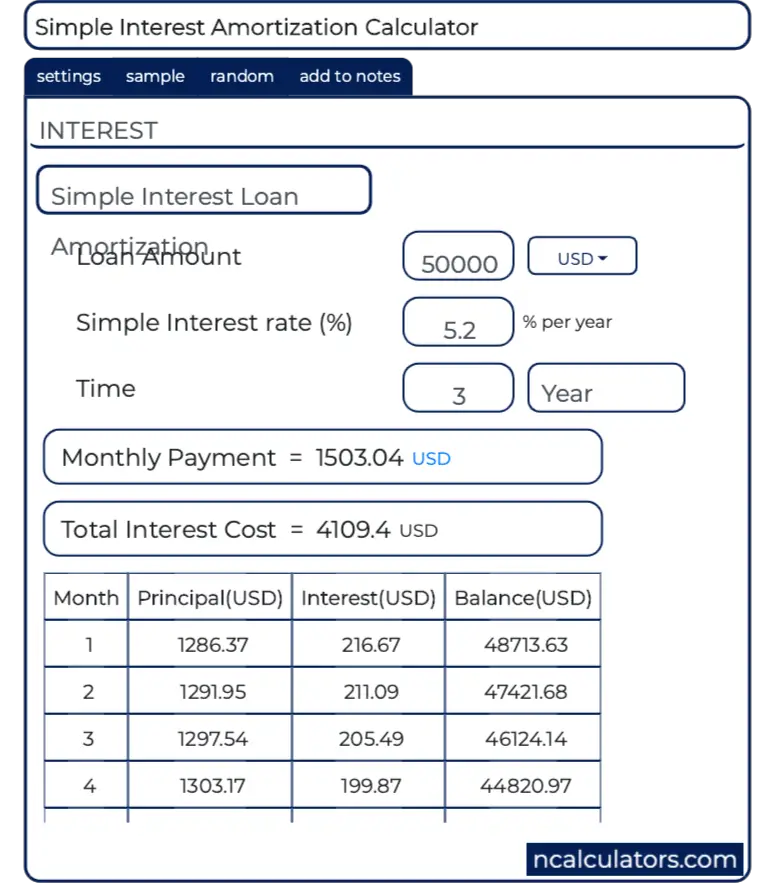

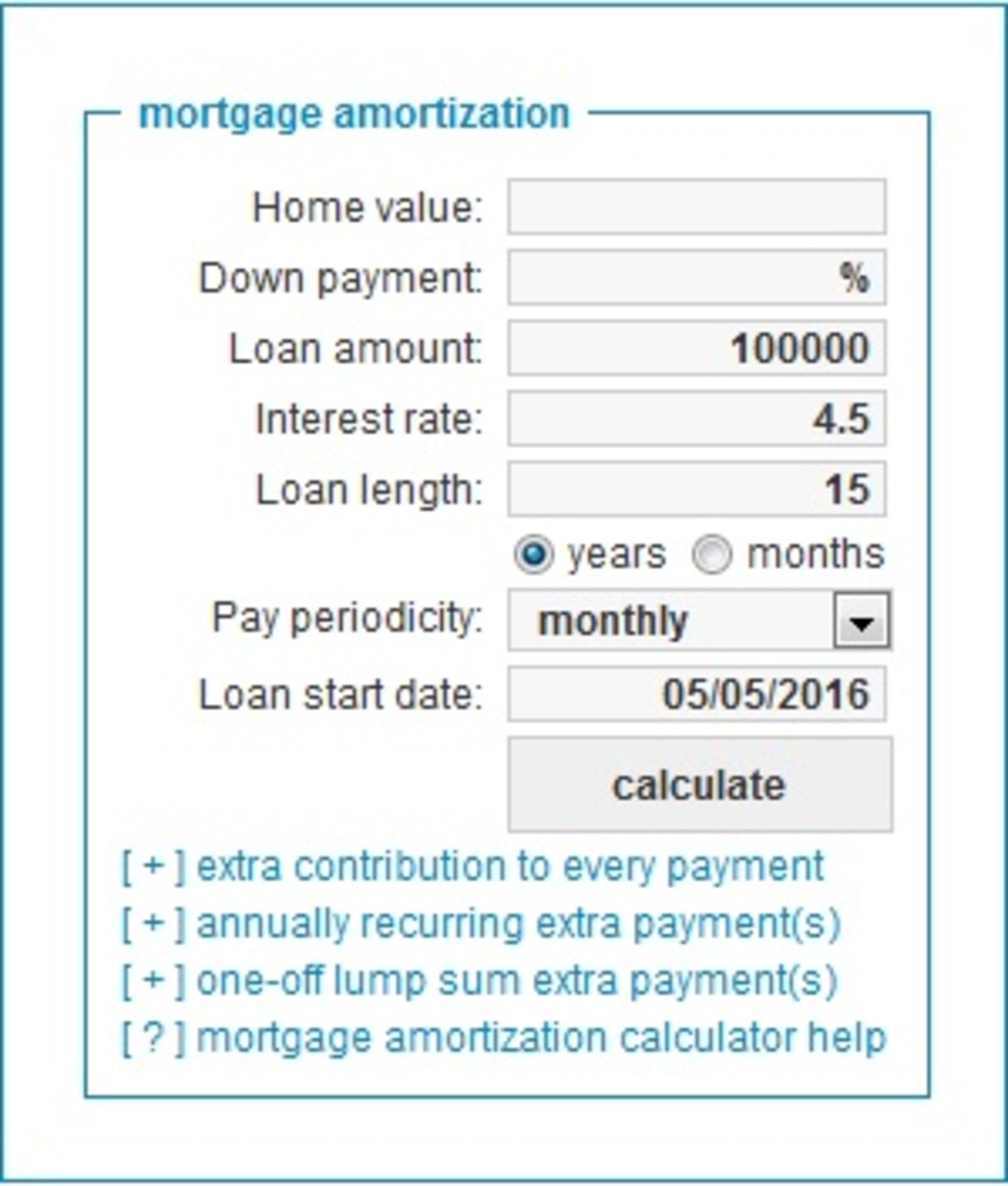

8 Undercover How To Calculate The Amortization. Period starting balance interest new balance periodic payment principal reduction unpaid balance 1 $100,000.00 $500.00 $100,500.00 $4,432.06 Mortgage amortization is a concept that allows your monthly payment to remain the same while the mix of principal and interest changes throughout the life of the loan. Calculate how much interest you'll save. How to calculate the amortization

Create an amortization schedule with extra payments or lump sum payment on any date. For example, if you borrowed $20,000 for 60 months and your apr was 5%, your payment would be $377.42. Your amortization schedule shows how much money you pay in principal and interest over time. How to calculate the amortization

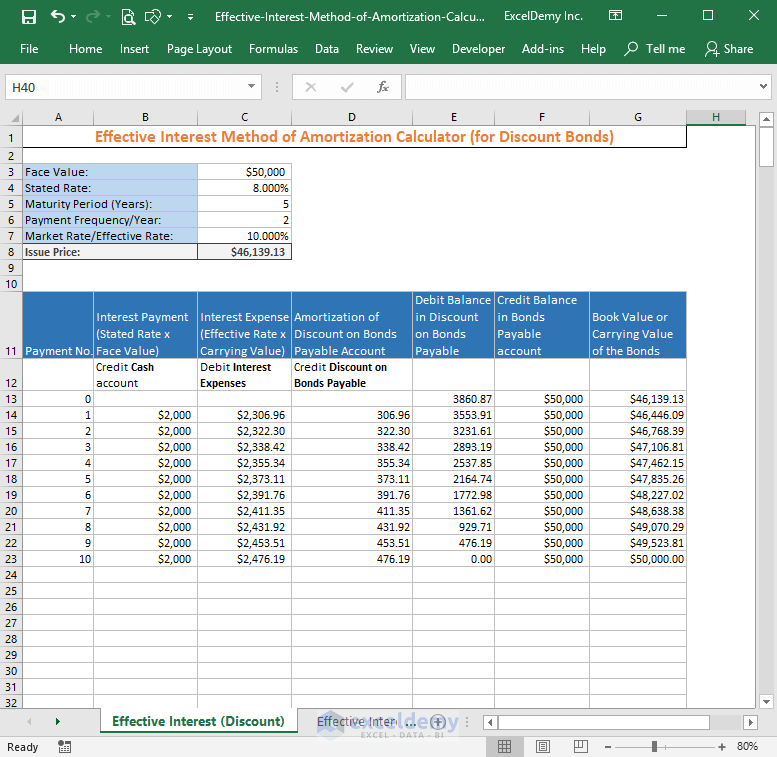

Amortized amount = premium / total accrual. An amortization schedule normally will show you how much interest and principal you are paying each period, and usually an amortization calculator will also calculate the total interest paid over the life of the loan. In this article, we’ll define what mortgage amortization is, how it works, and how you can calculate it. How to calculate the amortization

Read rest of the answer. Determining which intangible assets may be amortized and the correct capitalized value can sometimes be tricky. The term of the loan is 360 months (30 years). How to calculate the amortization

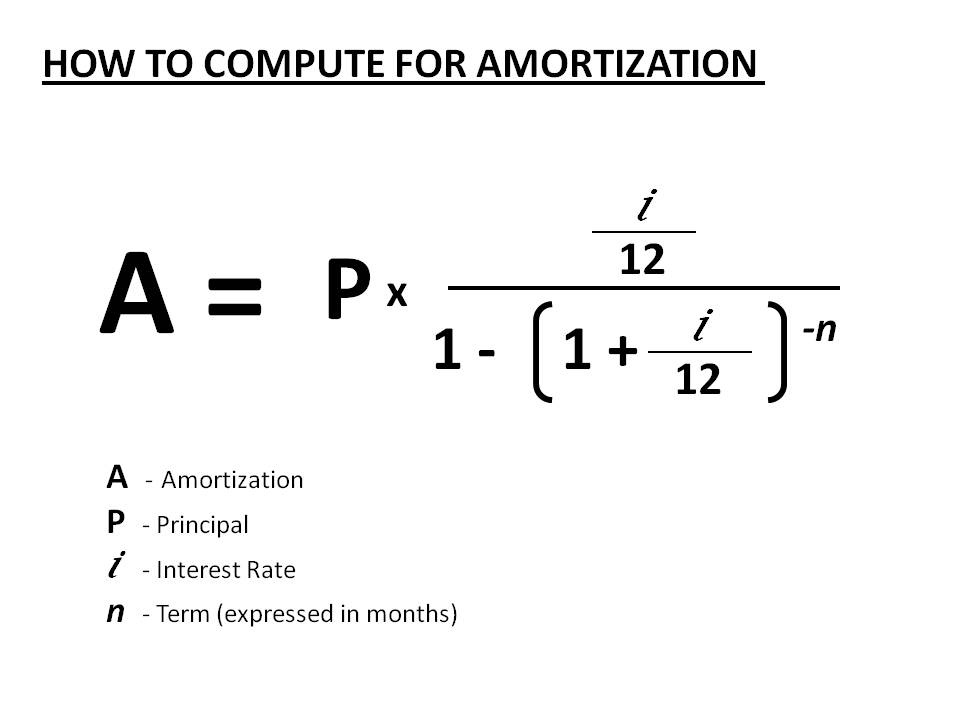

Calculate the amortization per year. Since amortization is a monthly. Then, multiply the monthly interest rate by the principal amount to find the first month’s interest. How to calculate the amortization

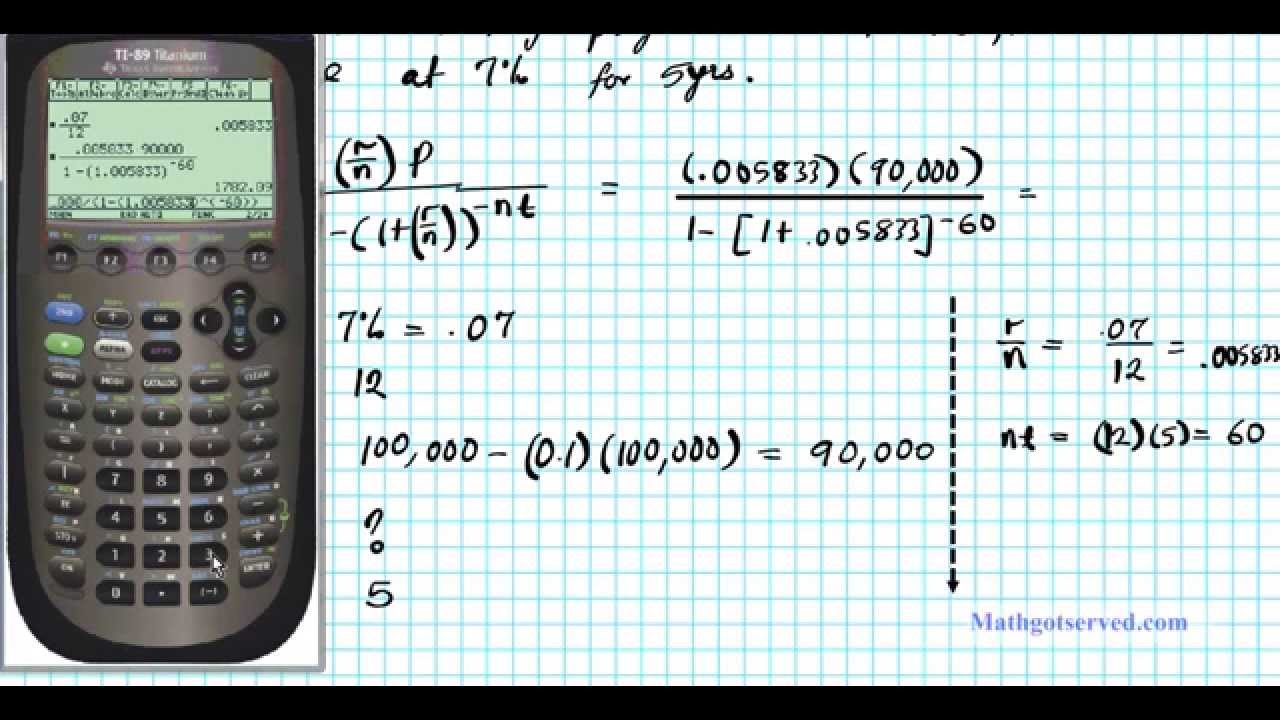

If you know these three things, you can use excel’s pmt function to calculate your monthly payment. This video shows how to calculate amortization payments. You divide the initial cost of the intangible asset by the estimated useful life of the intangible asset. How to calculate the amortization

The most contemporary financial calculators, spreadsheet software packages, and online amortization charts are used to calculate amortization. Therefore, $50,000 / 20 = $2,500. Guide to amortization formula, here we discuss its uses along with practical examples and also provide you calculator with downloadable excel template. How to calculate the amortization

How to calculate amortization with an extra payment if you make an extra payment on your loan , your lender could handle it in a few ways. When you multiply the interest rate with the outstanding loan balance and then dividing it by twelve you get the monthly payments. The amortization schedule study the payment schedule. How to calculate the amortization

Correspondingly, how do you calculate fixed assets. Notice when there is an. This method shown is one of many ways of how to calculate a lease amortization schedule. How to calculate the amortization

Amortization is an accounting technique used to periodically lower the book value of a loan or an intangible asset over a set period of time. To calculate amortization, start by dividing the loan’s interest rate by 12 to find the monthly interest rate. To calculate amortization, you will convert the annual interest rate into a monthly rate. How to calculate the amortization

It would be confusing for a company to try to write off the cost of an intangible asset with a definite life in any other way. Entries of amortization are made as a debit to amortization expense, whereas it is mentioned as a credit to the accumulated Next, subtract the first month’s interest from the monthly payment to find the principal payment amount. How to calculate the amortization

This video is provided by the learning assistance center of howard community college. An auto loan amortization schedule allows you to see that shift from month to month. Their schedules start with the outstanding loan balance. How to calculate the amortization

Amortization is a technique to calculate the progressive utilization of intangible assets in a company. To calculate the monthly amortization amount, divide the yearly amount by 12. Initial cost / useful life = amortization per year. How to calculate the amortization

Use this calculator to see how those payments break down over your loan term. While the amortization calculator can serve as a basic tool for most, if not all, amortization calculations, there are other calculators available on this website that are more specifically geared for. How to calculate the amortization

Amortization Schedule Formula Examples and Forms . While the amortization calculator can serve as a basic tool for most, if not all, amortization calculations, there are other calculators available on this website that are more specifically geared for.

Amortization Schedule Formula Examples and Forms . While the amortization calculator can serve as a basic tool for most, if not all, amortization calculations, there are other calculators available on this website that are more specifically geared for.

Effective Interest Method of Amortization Calculator (Free . Use this calculator to see how those payments break down over your loan term.

Effective Interest Method of Amortization Calculator (Free . Use this calculator to see how those payments break down over your loan term.

How to Calculate Amortization (with Illustrations) . Initial cost / useful life = amortization per year.

How to Calculate Amortization. . To calculate the monthly amortization amount, divide the yearly amount by 12.

How to Calculate Amortization. . To calculate the monthly amortization amount, divide the yearly amount by 12.

Best Online Amortization Calculators ToughNickel . Amortization is a technique to calculate the progressive utilization of intangible assets in a company.

Best Online Amortization Calculators ToughNickel . Amortization is a technique to calculate the progressive utilization of intangible assets in a company.

How To Compute The Monthly Amortization . Their schedules start with the outstanding loan balance.

How To Compute The Monthly Amortization . Their schedules start with the outstanding loan balance.

Comments

Post a Comment